Overview

Even as nations diversify their energy portfolios, fossil fuels are expected to meet a majority of the world’s energy demand for several decades. Accelerating deployment of carbon capture technology is essential to reduce emissions from these power plants, and from industrial plants like cement and steel manufacturing.

More than half of the models cited in the Intergovernmental Panel on Climate Change’s Fifth Assessment Report required carbon capture for a goal of staying within 2 degrees Celsius of warming from pre-industrial days. For models without carbon capture, emissions reduction costs rose 138 percent.

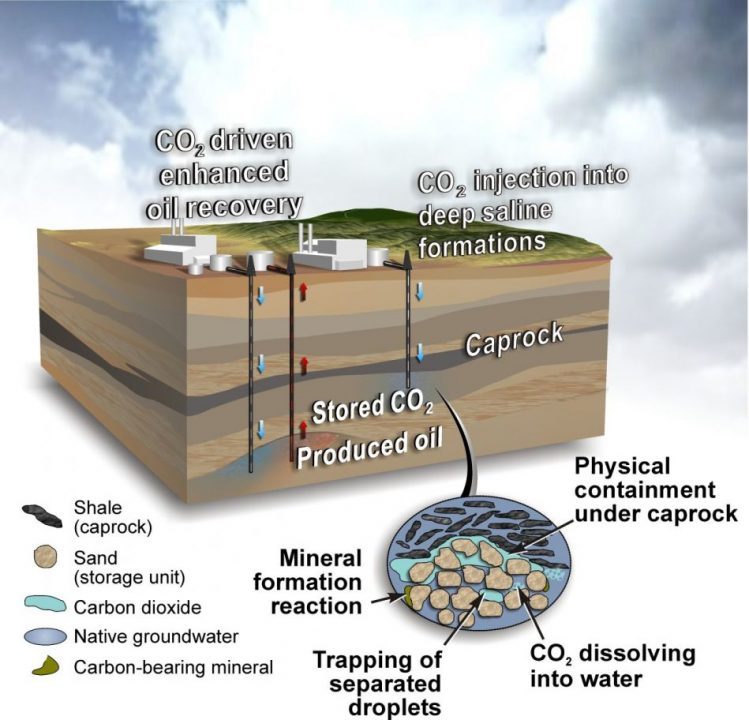

For nearly a half century, in a practice called enhanced oil recovery (EOR), carbon dioxide has been used to extract additional oil from developed oil fields in the United States. U.S. companies are also investing in new technologies to re-use captured carbon emissions in innovative ways, including jet fuel and automobile seats. Spurred by the NRG COSIA Carbon XPRIZE, researchers are exploring even more uses, such as transforming carbon emissions into algae biofuels and building materials.

As many experts see hydrogen as a clean fuel of the future and expect it to play a major role in decarbonizing the industrial sector, a process such as natural gas reforming with carbon capture technology presents itself as the lowest cost option for producing clean hydrogen. This process produces blue hydrogen by reforming natural gas into hydrogen and carbon dioxide; the carbon dioxide by-product will be captured, transported, and stored in deep geologic formations. The addition of carbon capture makes the hydrogen production process nearly emissions free, when clean electricity is used to power the carbon capture facility.

Policy Support for Carbon Capture

There is strong bipartisan support to accelerate carbon capture deployment. In February 2018, Congress extended and expanded key financial incentives for investment in several advanced low-carbon technologies. The two-year budget package included the FUTURE Act, sponsored by Senators Heidi Heitkamp (D-N.D.), Shelley Moore Capito (R-W.Va.), Sheldon Whitehouse (D-R.I.), and John Barrasso (R-Wyo.). The legislation reforms and extends a federal tax credit to boost carbon capture, known as Section 45Q. The FUTURE Act also allows for the first time use of the tax credit for capture of carbon monoxide from industrial facilities like steel mills, direct air capture (DAC) of CO2 from the atmosphere, and for the conversion of captured carbon into useful products.

In 2018, the California’s Low Carbon Fuel Standard (LCFS) was amended to enable carbon capture and storage projects that are associated with the production of transport fuels sold in California to generate LCFS credits. It also enabled DAC projects to generate credits regardless of their location even if they do not have a fuel component as the only exception to the rule. These changes came into effect in January 2019.

In December 2020, Congress enacted a two-year extension of the 45Q tax credit as a part of the Consolidated Appropriations Act, 2021 to require qualified facilities to commence construction by December 31, 2025.

In 2022, Congress enacted the Inflation Reduction Act (IRA) which provided the largest support for carbon capture to date. IRA extended the “commence construction” window for 45Q through the end of 2032. It also provided a “direct pay” option for the first 5 years of the tax credit after the carbon capture equipment is placed in service. Moreover, it enhanced the tax credit value for industrial and power generating facilities and introduced a new credit level for DAC.

Table1: Inflation Reduction Act support for carbon capture

|

IRA |

Previous legislation |

| Enhancing 45Q credit values for industrial and power plant carbon capture |

· $85/ton for saline storage

· $60/ton for carbon utilization

· $60/ton for EOR |

• $50/ton

• $35/ton

• $35/ton |

| Enhancing 45Q credit values for DAC |

· $180/ton for saline geologic storage

· $130/ton for carbon utilization

· $130/ton for EOR |

• $50/ton

• $35/ton

• $35/ton |

| Reduction of annual carbon capture thresholds |

· Electric Generating Facility: 18,750 tons/year

· Industrial facilities: 12,500 tons/year

· DAC: 1,000 tons/year |

• 500,000 tons/year

• 100,000 tons/year

• 100,000 tons year |

C2ES participates in a diverse coalition of industry, labor, and environmental groups that support expanding deployment of carbon capture. Other supporters of incentivizing carbon capture include the Western Governors Association, Southern States Energy Board, and National Association of Regulatory Utility Commissioner.

Carbon Capture in Action

As of 2020, at least 26 commercial-scale carbon capture projects are operating around the world with 21 more in early development and 13 in advanced development reaching front end engineering design (FEED). Industrial processes where large-scale carbon capture has been demonstrated and is in commercial operation include coal gasification, ethanol production, fertilizer production, natural gas processing, refinery hydrogen production and, most recently, coal-fired power generation.

Carbon Capture Milestones

1972: Terrell gas processing plant in Texas. A natural gas processing facility (along with several others) began supplying carbon dioxide in West Texas through the first large-scale, long-distance carbon dioxide pipeline to an oilfield.

1982: Koch Nitrogen Company Enid Fertilizer plant in Oklahoma. This fertilizer production plant supplies carbon dioxide to oil fields in southern Oklahoma.

1986: Exxon Shute Creek Gas Processing Facility in Wyoming. This natural gas processing plant serves ExxonMobil, Chevron, and Anadarko Petroleum carbon dioxide pipeline systems to oil fields in Wyoming and Colorado and is the largest commercial carbon capture facility in the world at 7 million tons of capacity annually.

1996: Sleipner Carbon Dioxide Storage Facility offshore of Norway. This project captures carbon dioxide from gas development for storage in an offshore sandstone reservoir. It was the world’s first geologic storage project. Roughly 0.85 million tonnes of CO2 is injected annually for a cumulative total of over 16.5 million tonnes as of January 2017.

2000: Dakota Gasification’s Great Plains Synfuels Plant in North Dakota. This coal gasification plant produces synthetic natural gas, fertilizer, and other byproducts. It has supplied over 30 million tons of carbon dioxide to Cenovus and Apache-operated EOR fields in southern Saskatchewan as of 2015.

2003: Core Energy/South Chester Gas Processing Plant in Michigan. Carbon dioxide is captured by Core Energy from natural gas processing for EOR in northern Michigan with over 2 million MT captured to date.

2008: Snøhvit Carbon Dioxide Storage offshore of Norway. Carbon dioxide is captured from an LNG facility on an island in the Barents Sea. The captured carbon dioxide is stored in an offshore subsurface reservoir. To date, more than 4 million tons of carbon dioxide have been stored.

2009: Chaparral/Conestoga Energy Partners’ Arkalon Bioethanol plant in Kansas. The first ethanol plant to deploy carbon capture, it supplies 170,000 tons of carbon dioxide per year to Chaparral Energy, which uses it for EOR in Texas oil fields.

2010: Occidental Petroleum’s Century Plant in Texas. The carbon dioxide stream from this natural gas processing facility is compressed and transported for use in the Permian Basin.

2012: Air Products Port Arthur Steam Methane Reformer Project in Texas. Two hydrogen production units at this refinery produce a million tons of carbon dioxide annually for use in Texas oilfields.

2012: Conestoga Energy Partners/PetroSantander Bonanza Bioethanol plant in Kansas. This ethanol plant captures and supplies roughly 100,000 tons of carbon dioxide per year to a Kansas EOR field.

2013: ConocoPhillips Lost Cabin plant in Wyoming. The carbon dioxide stream from this natural gas processing facility is compressed and transported to the Bell Creek oil field in Montana via Denbury Resources’ Greencore pipeline.

2013: Chaparral/CVR Energy Coffeyville Gasification Plant in Kansas. The carbon dioxide stream (approximately 850,000 tons per year) from a nitrogen fertilizer production process based on gasification of petroleum coke is captured, compressed and transported to a Chaparral-operated oil field in northeastern Oklahoma.

2013: Antrim Gas Plant in Michigan. Carbon dioxide from a gas processing plant owned by DTE Energy is captured at a rate of approximately 1,000 tons per day and injected into a nearby oil field operated by Core Energy in the Northern Reef Trend of the Michigan Basin.

2013: Petrobras Santos Basin Pre-Salt Oil Field CCS offshore of Brazil. This project involves capturing carbon dioxide from natural gas processing for use in enhanced oil recovery in the Lula and Sapinhoá oil fields.

2014: SaskPower Boundary Dam project in Saskatchewan, Canada. SaskPower completed the first commercial-scale retrofit of an existing coal-fired power plant with carbon capture technology, selling carbon dioxide locally for EOR in Saskatchewan.

2015: Shell Quest project in Alberta, Canada. Shell began operations on a bitumen upgrader complex that captures approximately one million tons of carbon dioxide annually from hydrogen production units and injects it into a deep saline formation.

2015: Uthmaniyah CO2-EOR Demonstration in Saudi Arabia. This project captures carbon dioxide from the Hawiyah natural gas liquids recovery plant. The captured carbon dioxide is used for enhanced oil recovery in the Ghawar oil field.

2016: Abu Dhabi CCS Project Phase 1: Emirates Steel Industries. Carbon capture technology was deployed for the first time on an operating iron and steel plant. The captured carbon dioxide is used for enhanced oil recovery by the Abu Dhabi National Oil Company.

2017: NRG Petra Nova project in Texas. NRG completed on time and on budget a project to capture 90 percent of the carbon dioxide from a 240 MW slipstream of flue gas of its existing WA Parish plant, or roughly 1.6 million tons of carbon dioxide per year. The carbon dioxide is transported to an oil field nearby.

2017: ADM Illinois Industrial Carbon Capture & Storage Project. Archer Daniels Midland began capturing carbon dioxide from an ethanol production facility and sequestering it in a nearby deep saline formation. The project can capture up to 1.1 million tons of carbon dioxide per year.

2020: Boundary Dam 3 facility in Saskatchewan, Canada surpassed over 4 million tons of CO2 captured and stored.

2020: Shell Quest project in Alberta, Canada which captures CO2 from a hydrogen production unit at the Scotford refinery surpassed 5 million tons of CO2 stored.

2020: NRG Petra Nova Project in Texas was idled due to the collapse of West Texas crude oil prices early in the COVID-19 pandemic.

2020: Hydrogen to Humber Saltend (H2H Saltend) project in the UK. Norwegian energy company Equinor announced a project to produce zero-emission hydrogen from natural gas in combination with carbon capture and storage technology to provide clean energy to the Humber region, the UK’S largest industrial cluster.