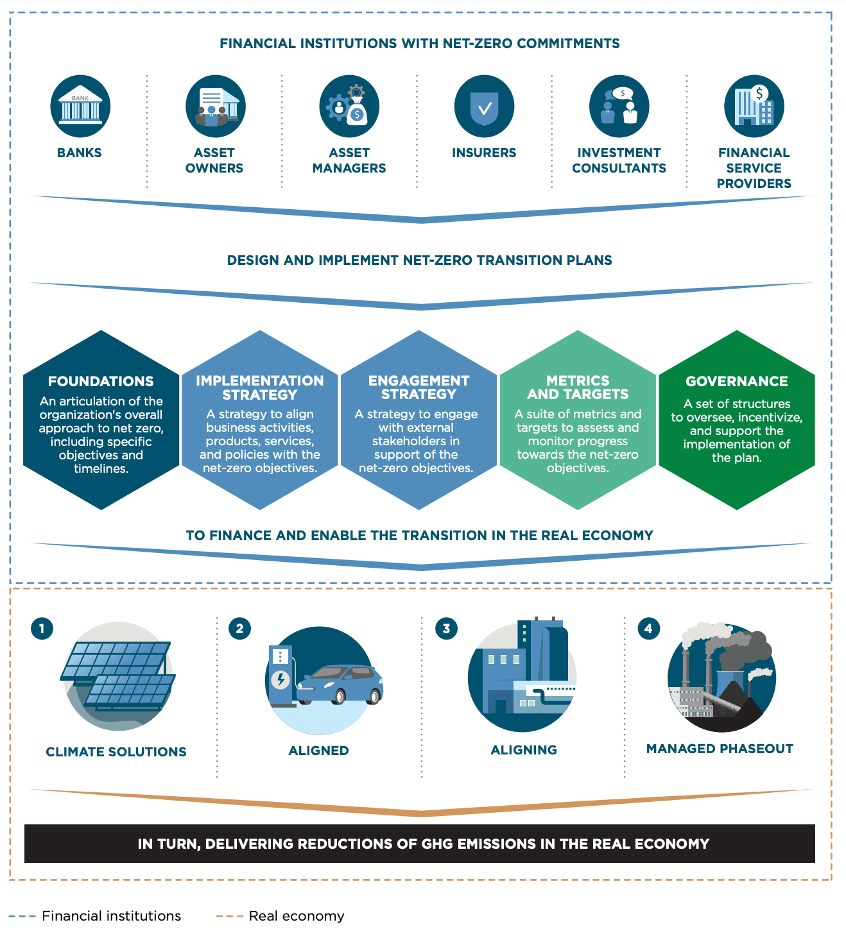

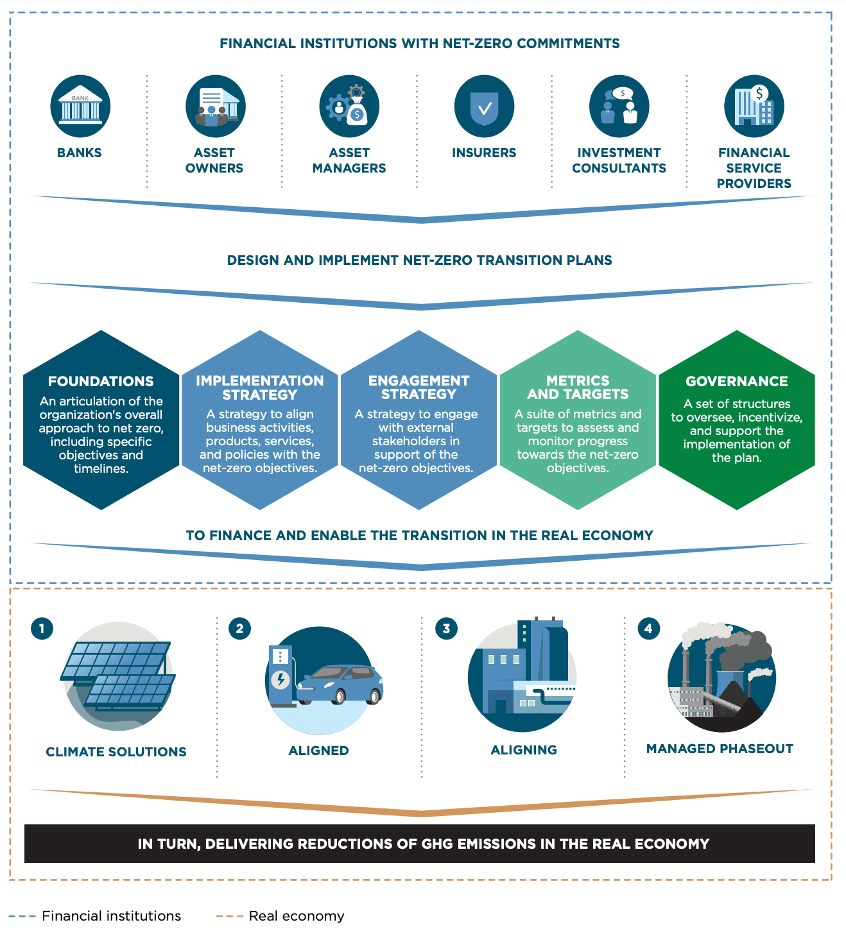

Financial institutions will take different approaches to achieving net zero targets and prioritize areas of their business depending on factors, including the size of the organization, their business model, influence, operating environment, portfolio and client characteristics, and geographic coverage. As detailed in the “Defining transition finance” section of GFANZ Recommendations and Guidance on Financial Institutions Net Zero Transition Plans, the key financing strategies that financial institutions may choose to prioritize are focused on financing climate solutions, supporting already aligned firms, supporting real economy firms committed to aligning, and financing managed phaseout projects.

Defining these priorities allows an institution to develop a detailed and strategic net zero transition plan. The plan, guided by the objectives and priorities, will include decisions such as resourcing, incentives, which analytical processes to modify, and how to adapt priority business units, products and services, engagement plans, and other core business levers.

How the financial sector supports the global real economy in reaching net zero

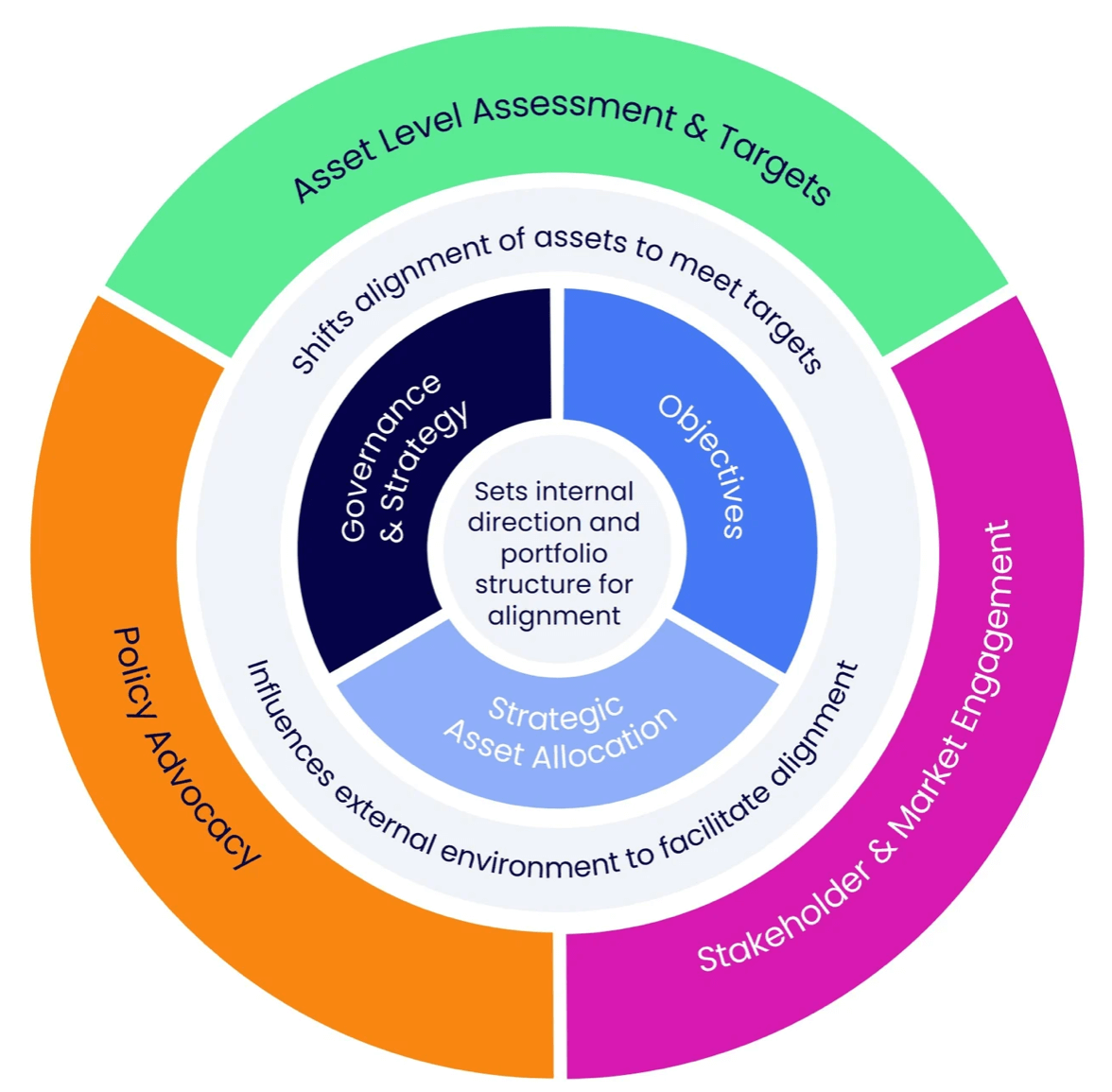

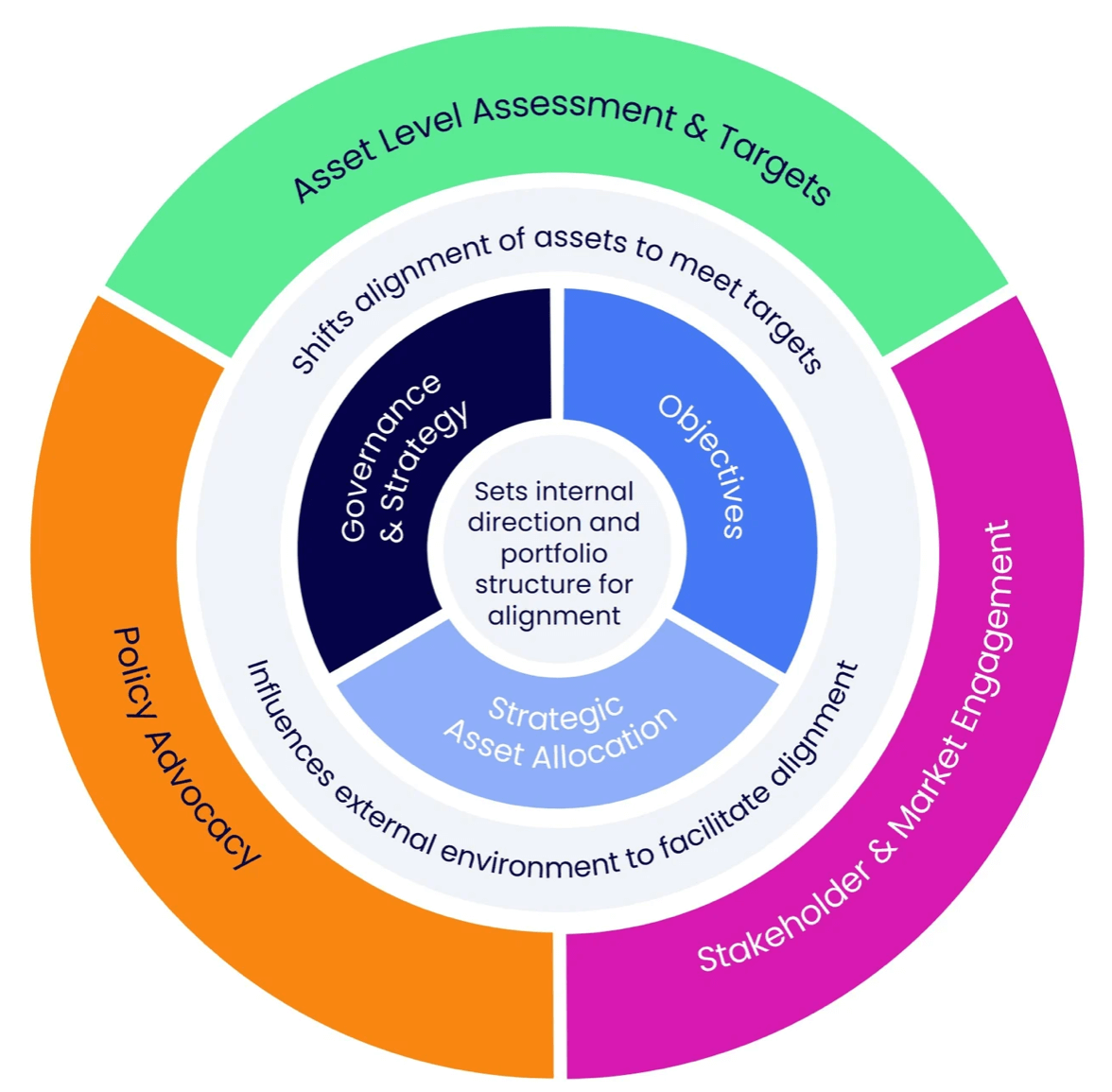

The Net Zero Investment Framework (NZIF) is a model that helps investors align portfolios with net zero goals by setting targets, measuring progress, and integrating climate-related risks. It guides capital allocation to drive real-world decarbonization and supports the net zero economy. The NZIF 2.0 enhanced framework offers improved methodologies for portfolio alignment, target-setting, and transition finance. It refines key concepts like the Portfolio Decarbonization Reference Objective and Asset Alignment Target, ensuring investors can accelerate emissions reductions. By prioritizing climate solutions, aligned firms, and phaseout projects, NZIF 2.0 enables financial institutions to develop net zero transition plans and drive systemic change.

The NZIF Wheel highlights the interconnected nature of net -zero strategies, emphasizing the equal importance of key elements: Governance & Strategy, Objectives, Strategic Asset Allocation, Asset Level Assessment & Targets, Policy Advocacy, and Stakeholder & Market Engagement. This structure ensures that investment decisions, engagement efforts, and policy advocacy work together to facilitate real economy decarbonization. By leveraging these tools, financial institutions can create the conditions necessary for reducing emissions across industries and accelerating the global transition.

Similarly, GFANZ Recommendations and Guidance on Finance Sector Transition Plans acknowledges this linkage and outlines four key financing strategies that support the real economy’s transition to net zero:

- Financing Climate Solutions – Investing in projects like renewable energy and sustainable infrastructure.

- Supporting Already Aligned Firms – Backing companies already operating in line with net zero goals.

- Supporting Transitioning Firms – Providing capital and guidance to companies committed to decarbonization.

- Financing Managed Phaseout – Funding the responsible retirement of high-emission assets.

These strategies enable financial institutions to direct capital toward real-world emissions reductions, accelerating the global transition.

Just Transition

Investors can play a pivotal role in promoting a just transition by integrating social considerations into their climate strategies. This involves aligning investment practices with environmental sustainability while ensuring social equity. Key actions include engaging with companies to encourage fair labor practices, supporting community development initiatives, and advocating for policies that facilitate an inclusive transition to a net zero economy. By adopting these approaches, investors can help mitigate the social risks associated with climate change and contribute to sustainable economic development.