Policy Options

Carbon Price

A price on carbon, such as a greenhouse gas cap-and-trade program, would raise the cost of electricity produced from fossil fuels relative to low-carbon sources. Electric energy storage would then have increased value where relatively inexpensive low-carbon electricity could be stored to displace carbon-intensive power.

Real-Time Electricity Pricing

If consumers were charged a real-time, dynamic price for electricity, the high cost of peak electricity would be transparent, and investments in electric energy storage to reduce peak load would have greater value. A national smart grid would facilitate real-time electricity pricing. California has started transitioning its commercial, industrial, and agriculture customers to this pricing structure as a result of a directive from the California Public Utilities Commission.

Mandates

Statewide mandates can increase deployment of electric energy storage technologies. California, Massachusetts, Nevada, New York, and Oregon have instituted statewide storage mandates of varying scales.

Markets for Ancillary Electric Services

Electric energy storage technologies would benefit from receiving prices set by competitive markets for ancillary electric services such as regulation, spinning reserve, and load-following.

Relaxation of Ownership Restrictions

Electric energy storage can serve generation and transmission functions, but existing deregulated electricity markets place limits on who can own such facilities. Removing restrictions on the ownership of energy storage facilities by end-use customers, transmission owners, or distribution companies could enable greater market penetration.

Integration of Electric Energy Storage in Transmission Planning

Decisions regarding new transmission lines could factor in the location of large-scale electric energy storage sites, demand centers and generation facilities. Investments in energy storage are often less costly than building new transmission lines. The Federal Energy Regulatory Commission could modify rules so that energy storage is subject to transmission pricing incentives and is a part of the transmission planning process.

Basic and Applied Research and Development

Low charge/discharge efficiencies, low cycle lives, and high capital costs make most electric energy storage technologies less economically competitive for smoothing out renewable energy or providing power quality services compared to power plants that provide similar services. Investments and incentives in basic and applied research and development would improve the performance of existing technologies and support breakthroughs for the next generation of energy storage technologies. In 2016, DOE’s ARPA-E program provided $37 million toward a new program to identify how solid ion conductors may improve energy storage by increasing battery capacity and preventing short circuits and degradation.

Challenges

High Capital Costs

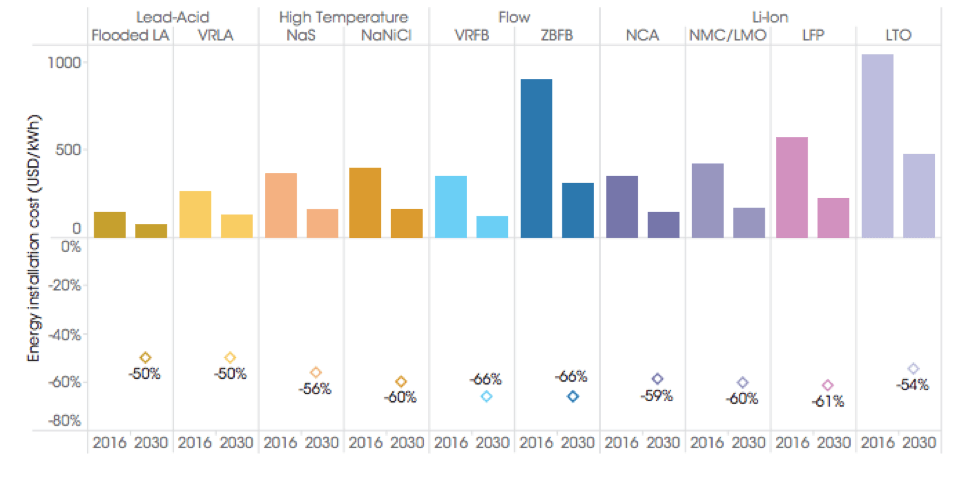

Capital costs of most electric energy storage technologies are still high compared to natural gas generators that provide similar services, but costs for batteries have recently declined significantly and are still expected to continue to do so.

Need for Large-Scale Demonstration Projects

Electric energy storage technologies such as CAES require a few large-scale demonstration projects before utility managers will have the confidence to invest in them. Other types of storage such as SMES will also require large-scale demonstrations before wider adoption can take place.

Transmission Planning Processes

Transmission planning only takes into account the location of demand centers and generation facilities. As a result, geographically remote electric energy storage facilities like pumped hydro or CAES have limited access to the transmission grid.

Regulatory Barriers

Federal and state regulations treat electric energy storage as a type of electricity generation technology rather than as an investment in transmission capacity. Thus, transmission and distribution companies are barred from owning electric energy storage. Another barrier is the lack of utility rate decoupling in states. Since utility profits are typically tied to the volume of energy sales, there is an incentive to sell more energy. Under decoupling, programs like energy efficiency and greater energy storage deployment are more likely to be promoted. In addition, most renewable portfolio standards or government investment or production incentives exclude energy storage, despite the fact that energy storage can enable higher penetration of renewables.

Unfinished Electricity Markets

Most regions of the United States have not yet fully developed markets and transparent prices for all the types of ancillary services that electric energy storage (and generation) technologies provide besides providing electricity, such as regulation, spinning reserve, load-following, and other services.