As the 119th Congress and new administration settle in, there is an evident shift in priorities relating to American energy development and what the role of the federal government should be. The new administration has articulated an interest in ensuring an “abundant supply of reliable energy is readily accessible in every state and territory of the nation,” and members of Congress have repeatedly signaled their interest in promoting an American energy industry that supports our global competitiveness.

C2ES has met with leaders of companies and communities in 18 states through our Regional Roundtable Program, and has seen firsthand the emerging consensus that building American advanced energy solutions like hydrogen, batteries, sustainable aviation fuel, wind, electric vehicles, and carbon management produce significant economic benefits for communities and promotes prosperity for people, while creating the “abundant supply” of energy needed to meet growing demand.

For example, in 2023, we heard from companies in Wyoming, Texas, and Ohio that access to low-cost, clean electricity was a central consideration in their ability to build new sites and grow operations in these states. Last year, we heard a similar message from leaders across South Carolina and Kentucky, who highlighted that the global market pressures to utilize increasing shares of clean energy are driving investment decisions.

Federal incentives are providing American companies with the support needed to make transformative investments, creating thousands of good jobs across America, particularly communities who have powered the nation’s prosperity for more than a century. Smart and complementary tax credits are already delivering benefits across the manufacturing supply chain – from the clean energy necessary to power the facility to raw materials and intermediate energy components, to the final energy products needed to unlock American energy security and affordability. Some of the incentives with the highest potential impact include:

- Advanced manufacturing tax credits (45X and 48C), which support projects to expand the manufacturing, recycling, and mining of clean energy products, components, and raw materials

- The technology-neutral clean electricity credits (45Y and 48E), which incentivize clean energy production and investment

- The clean fuels tax credits (45V and 45Z), which support the production of clean hydrogen, sustainable aviation fuel, and other clean fuels

Onshoring these crucial industries and supply chains to American communities is paramount in helping the United States lead the global race to energy dominance. If the United States steps back from advanced energy investments now, global competitors like China and the European Union will have an incredible opportunity to tilt the market in their favor over the long-term. The geo-political and economic repercussions of this outcome will reverberate through U.S. communities at a time when so many are facing daunting economic challenges of their own.

Establishing these federal incentives was crucial to kicking off the recent boom of American advanced energy production, and maintaining certainty for these investments is vital to building the supply chains and industries that will help secure the country’s long-term economic health.

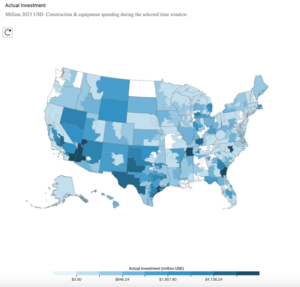

American Advanced Energy Investments since the 2022 establishment of federal incentives

Source: Rhodium Group (2025)

By maintaining the key advanced energy tax credits and other federal investments in the American advanced energy supply chain, we can create jobs and economic growth for communities, promote lower-cost electricity for families and businesses, and promote American global leadership in the advanced energy economy.