California’s cap-and-trade program received court affirmation this month that the state has authority to auction allowances. But questions remain about the program’s future.

California lawmakers are evaluating ways to achieve the state’s 2030 greenhouse gas reduction goal. One option, championed by Governor Brown, is to extend its cap-and-trade program. But some lawmakers are concerned the program isn’t delivering the expected revenues for state clean energy programs. Others worry it doesn’t do enough to provide equitable environmental co-benefits.

Could the single step of extending the program address these concerns? To some extent, yes.

The debate in Sacramento

Under California’s cap-and-trade program, operating since 2013, emissions are down and economic productivity is up.

But there are some areas of concern. Auction revenues are down. As I’ve noted before, low carbon prices don’t mean a cap-and-trade program isn’t working. They just mean the required emissions reductions are cheap. But California legislators want to use auction revenue to fund other projects like planting trees in urban areas and putting rooftop solar panels in disadvantaged communities. More importantly, a recent analysis shows emitters are more likely to be near disadvantaged communities, raising concern Californians won’t enjoy the co-benefits, like cleaner air, equally.

Legislators have proposed extending the cap-and-trade program through 2030, although they are debating restricting how it operates. Discussion continues about replacing cap-and-trade with a carbon tax approach. This tax proposal would seek to address the first concern, that allowance prices are too low to fund desired programs. Other debate centers around restrictions to force more emissions reductions to occur inside the state. Current rules allow for reductions at sources of electricity outside California, or at limited offset project sites in the U.S. and Canada.

Economic theory tells us that limiting emissions through a cap-and-trade program will achieve the environmental objective at the least cost, through business innovation. Could lowering the cap address other key concerns as well?

Tighter cap = higher revenues

The California Air Resources Board’s (CARB) 2017 Climate Change Scoping Plan Update (Scoping Plan) evaluates policy options to achieve the 2030 goal. The regulator’s preferred approach is to keep existing programs (like the state’s aggressive 50 percent Renewable Portfolio Standard), extend the cap-and-trade program, and require extra emissions reductions at in-state refineries. Its analysis concludes this would meet the 2030 goal, using market-based approaches to minimize costs while prioritizing in-state reductions.

Using the information in the Scoping Plan, let’s examine how CARB’s preferred policy approach would address concerns about revenue and equity.

First, compare actual auction revenue in 2016 with projections of how revenue might change if the cap-and-trade program were extended (see Table 1). Making some conservative assumptions, revenues could double by 2020, from $2 billion without an extended cap to $4 billion with an extended cap. The increase comes mostly from increased allowance demand that would be expected if the business community receives a long-term policy signal in favor of cap-and-trade. Auction revenue could reach $5 billion in 2025, even as the cap (and the number of allowances sold) declines.

Table 1. Relationship between allowance supply and state revenue.

2016 values are calculated from CARB data. Projections for 2020 are based on CARB’s projected auction volumes and our conservative price estimates. Projections for 2025 are estimated assuming a linear cap decline and no significant changes to program allocation rules. Current program rules set a minimum auction price of $15.40 in 2020. The minimum price would be $19.70 in 2025 under the current escalation rate.

| Illustrative scenario | Annual allowance sales at auction (tons, all vintages*) | Annual average auction clearing price ($/ton) | Annual state revenue ($) |

| 2016 actual values | 168,076,078 | $12.73 | $2,139,608,473 |

| 2020 projection, BAU policy** | 133,632,293 | $15.40 | $2,057,937,311 |

| 2020 projection, extended cap-and-trade policy*** | 259,197,485 | $16.00 | $4,147,159,760 |

| 2025 projection, extended cap-and-trade policy*** | 211,618,003 | $25.00 | $5,290,450,075 |

*The vintage is the first year in which the allowance is eligible for compliance. California currently auctions a small number of allowances three years in advance (“future vintages”), to promote price discovery and liquidity in the market.

**Assumes auctions are subscribed at same level as 2016, but no future vintages offered.

***Assumes current and future vintage auctions are fully subscribed

Source: CARB data and C2ES calculations.

These calculations are based on the observation that allowance demand (and prices) increase when businesses receive policy signals that buying allowances will be a good long-term investment. Experience in both Europe and the U.S. Northeast’s Regional Greenhouse Gas Initiative has borne this out. Each of those markets has had periods of low prices. When rulemakers responded by tightening the cap, allowance prices increased.

A key point from those experiences is that the market didn’t wait to respond after the agreed cuts took place – prices increased as soon as the legislation was passed. Legislators can boost state revenue for greenhouse gas reduction programs today by committing to the market through 2030.

Tighter cap = greater co-benefits

But what about concerns that the trading provision doesn’t allow disadvantaged communities to enjoy equal co-benefits, like fewer criteria air pollutants (SO2, NOx, PM 2.5), from the regulation?

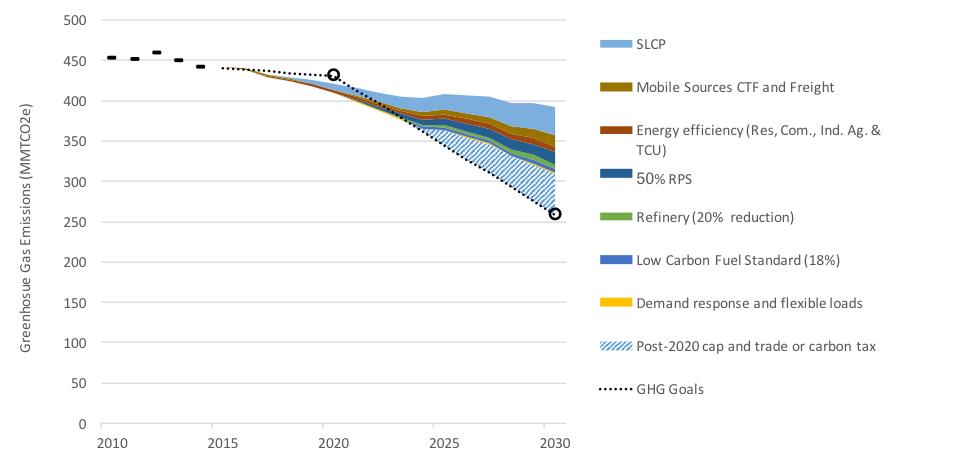

It is worth noting that the cap-and-trade program is not the state’s sole policy measure aimed at reducing greenhouse gases. Figure 1 shows the reductions each measure in CARB’s preferred plan is expected to produce. The total reductions needed to meet the 2030 target are estimated at 680 million tons (Mt). CARB expects other policies will reduce at least 339 Mt and potentially 489 Mt (the figure shows the high value). The cap-and-trade program is expected to make up the difference, or 28-50 percent of the required reductions.

While a detailed analysis is required to estimate cap-and-trade compliance pathways, it is reasonable to assume that improved energy efficiency and substituting cleaner fuels would play a major role. These actions also reduce criteria air pollutants as a co-benefit. A potential 50 percent cut in these pollutants would make a big difference in the air quality near covered sources.